In this ever changing finance industry, the standout product is a Peer-to-Peer lending app, and it has made a significant mark. It surpasses traditional financial methods and gives direct access to money with low interest rates and easy returns for individuals or small businesses.

In the current evolution of financial technology, Fintech has marked a new era with peer-to-peer apps leading the way.

The P2P lending apps are developed to connect lenders and borrowers directly. There has been a great increase in the number of new users in the P2P sector.

As per the financial analyst’s stats, there is a surge in peer-to-peer lending app yields of 14-16 % compared to other assets. But first and foremost, let’s learn what a Peer-to-Peer lending app is and how it works.

What is a Peer-to-Peer Lending App?

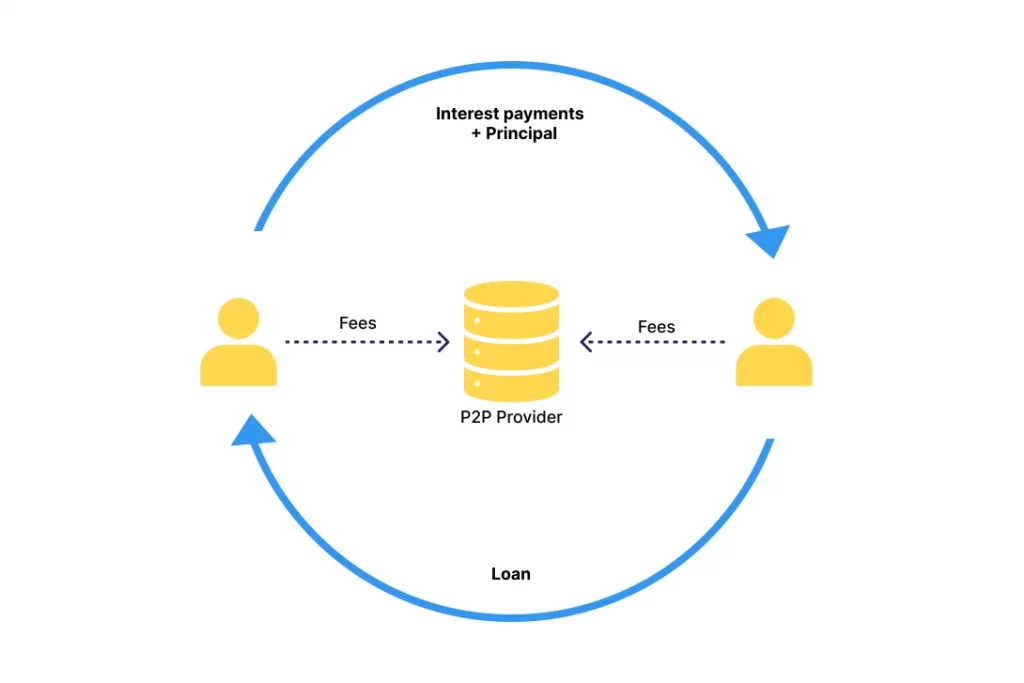

P2P lending apps are a digital platform that enables direct loans between lenders and borrowers. It allows the stakeholders to step aside from the traditional baking method.

The lending apps offer lower interest rates and high returns by cutting out intermediaries. However, it is important for both lenders and borrowers to thoughtfully assess the risks and benefits before participating in lending.

The use of P2P lending apps is user-friendly; the user first login requests a loan, and chooses the appropriate lender to get the funding. Once the funding is done, over the period, pay the loan repayment to the lender with fixed interest alongside the platform fees. Users can also benefit from ratings and reviews to gain trust and credibility on the platform.

Here, we will list the best Peer-to-Peer lending apps to understand the market and platform.

An Insightful Read: Top 9 FinTech trends to look out for in 2024-2025

Top 9 Peer To Peer Lending Apps

If you want to seek a loan or invest in a Peer-to-Peer lending app, choose the correct platform. You can kick start with our top nine selected apps from the market.

1. Upstart

2. SoFi

3. Zest AI

4. Pagaya

5. Commonbond

6. Amount

7. Prosper

8. Peerform

9. Zirtue

Upstart

The Upstart is one of the oldest P2P lending apps. It is a leading platform that connects consumers with more than 100 banks and credit unions. The app utilizes the advanced software solution with the cloud application to offer optimized credit products.

The Upstart app caters to a broad spectrum of users, including fair average credit and different types of loans, such as automotive, personal, small-dollar, and home loans.

SoFi

The SoFi is the short name of Social Finance. This online platform is a leading Peer-to-Peer lending app that offers a wide range of loan types. It offers diverse loan offerings and value-added services like financing advice and unemployment protection.

SoFi debt-free people from consolidation to offer loans for specialized travel needs and more. SoFi is committed to giving its users financial independence; the platform ensures funds are funded in all US states.

Zest AI

Zest AI is an exceptional lending app that gives credit underwriting services used for big data analytics and assists lenders in making more accurate loan decisions. It helps lenders analyze the borrowers beyond their typical credit score.

It uses AI machine learning to consider a range of factors like assessing creditworthiness, and it can also help lenders to approve more applicants, which can be overlooked in traditional ways.

Pagaya

Pagaya is a financial technology Peer-to-Peer lending app which redefines asset management. It manages the institutional money with big data analytics and AI machine learning.

Pagaya offers discretionary funds that institutional investors like banks, insurance companies, and pension funds focus on fixed alternative credit and fixed income.

The app’s technology platforms combine cutting-edge algorithms and artificial intelligence to give users continuous scalable and high-performance benefits.

Commonbond

The Commonbond is a remarkable peer-to-peer lending app that provides businesses and consumers with various student-related loans and solutions. They give students more openness, inexperience, and clear solutions to pay off their debt and help consumers.

The app uses firm benefits from tech-forward engagement skills and acquisition. The loan production is speedy, efficient, and transparent with compliance requirements.

Amount

Amount is listed as one of the best Peer-to-Peer lending apps. The technology was developed with the purpose of speeding up the distribution of operations. Amount evolves and enables digital transformation as the financial sectors change.

It adds the benefits of compliance requirements, operations, revenue, etc. Amount’s mission is to offer banks and financial institutions help for digital agility and energize positive changes in value, relevance, and customer impact.

Prosper

The Prosper was the first Peer-to-Peer lending app in the USA. Since then, it has successfully covered over $19 billion in funds to more than 1 billion borrowers. Prosper is indeed the pioneer of peer-to-peer lending apps in the marketplace.

The Prosper is easy to use, allows you to check the investment performance, and allows you to manage the portfolio with a mobile app. As per reports, almost 84% of all the investors have exceeded or attained their anticipated return on the investment, with an average return of 5.5%.

Peerform

Peerform is a professional banking and technologically skilled Peer-to-Peer lending app. The app was developed for individuals and small company owners who were hesitant to take traditional bank loans. The Peerform app connected the established loan investors and borrowers.

It allowed the investors to earn great interest rates on their assets as they could get standard banking investments like saving accounts, certificate deposits, or market accounts.

Zirtue

Zirtue is on the list of the best Peer-to-Peer apps because it automates loan payments between friends, family, and trusted contacts. When both sides agree on a loan payback plan, then money is automatically deducted from the payer’s bank account on fixed timelines.

It eliminates all the levels and repayment requests; zero costs are associated with using Zirture. However, there is a 5% annual percentage rate that needs to be sent to the borrower for the loan duration.

Recommended Read: 23 Best Money Transfer Apps for 2024

Key Advantages of Peer-to-Peer Lending Apps

Every Peer-to-Peer lending app is different in its own set of features and solutions in the market. These apps include some core features and functionalities, making them advantageous in many ways.

Proven Solid Returns

The Platforms used in P2P lending apps offer attractive returns compared to traditional savings accounts or bonds, and these often yield lower interest rates.

Investors have the opportunity to get high returns by directly lending to small businesses or individuals after cutting out on intermediaries like banks.

Reduced Risks

The P2P lending app has features for calculating risks and assessment algorithms to evaluate the borrower’s creditworthiness.

A great diversification strategy allows the investors to spread their money across different loans, reducing the impact of potential defaults.

Some platforms give protection mechanisms, like loan repurchase guarantees or insurance, further mitigating the risk for investors.

Short Duration

These peer loans are of shorter duration compared to typical bank loans or other bonds. It ranges from a few months to a few years.

These shorter loan durability give investors a chance to quickly reinvest their principal and interest payments, maximizing their potential for overall returns.

Simplicity

Peer-to-peer lending apps have intuitive interfaces, making them easy for users to use. The app has simple navigation to sign up, search for loans, and invest or borrow funds.

The lending process is streamlined correctly and can be processed and completed without any paperwork or physical visit to a bank branch.

Personalized Financing options

In the Peer apps, the borrowers can explore the wide range of loan options that can be tailored to meet their specific needs.

These platforms offer more flexibility regarding amount, interest rates, repayment timing, etc. Depending on their financial situation, borrowers can choose the best-fit loan.

Enhanced Transparency and Visibility

The Peer-to-Peer lending app provides detailed information on borrowers’ profiles, risk assessments, loan purposes, and more to lenders for better transparency.

Investors can easily track the performance of their investment through their dashboards and tools, giving visibility into their portfolio, returns, and risks.

Final Thoughts on P2P Lending Apps

Some of the best peer-to-peer lending apps have impacted the fintech market hugely in recent times. These apps open endless possibilities for investors and borrowers to invest and grow their money.

At Openxcell, our experienced team crafts bespoke financial software solutions specially tailored to your P2P lending app needs. We bring your concepts to life, meticulously building apps that not only meet but exceed the client’s expectations.

FAQ

1. What is Peer-to-Peer lending?

The Peer-to-Peer lending apps are a platform to get debt financing for individuals or small businesses without any traditional financial institution as an intermediary. It connects the borrowers directly to the lender through the online marketplace.

2. How does the P2P lending process work?

After the borrower signs up with the application, they can list the loans of specific amounts and interests that meet their requirements. Lenders can review their requests and choose to fund based on their investment preferences. Once the process is done, the borrower can repay the amount within the specified period.

3. Is Peer-to-Peer lending safe?

In P2P apps, there is limited potential for risk and platform failure. These platforms have reputable employees who employ risk assessment tools, screening processes, collection procedures, and more to eliminate risk. Investors can easily diversify their investments using multiple bonds and due diligence before lending.