Key Takeaways

- The booming venture capital investments in fintech highlight the surge in demand for innovative fintech app development that offers tailored financial solutions.

- To build successful fintech apps, integrating third-party financial services features like fraud detection, data analysis, and secure payments are needed for a rich user experience.

- Before building any fintech app, prioritize audience needs and utilize interactive prototypes to test the app with the users and make a user-friendly application.

“Fintech” is a new, widely used term in the financial industry. The fintech application development is a new-age digital tool built with cutting-edge technology to automate and enhance customers’ experience. By prioritizing security measures, the apps give easy solutions for different financial tasks performed by customers.

Before exploring the fintech app development, here is an overview of the fintech market and its growth over the years.

- The global fintech market boasts a real value of more than $226 billion.

- Experts project the fintech market’s annual growth rate will be 16.8% from 2024 to 2032, reaching a value of $918 billion.

- The personal finance software market will ultimately reach $360.4 million by 2030.

- The contactless payment market, driven by technologies like QR codes and wearable payments, is expected to surpass $132.42 billion by 2032.

- The Buy Now, Pay Later ( BNPL) market is forecast to see sustainable growth of 232,23 billion in 2024.

- A staggering 56% of people rely on digital financial tools, with 71% of millennials leading the way and 65% Genz, respectively.

What is a Fintech App?

Fintech is a combination of the words “finical” and “technology,” referring to financial technology applications. Fintech app development works with software tools that use modern technology to simplify and enhance users’ money management.

Fintech apps offer a wide range of services, like mobile banking, investments, peer-to-peer payments, budgeting tools, and more. Its goal is to make financial transactions faster, easier, efficient, and accessible for a broader population.

The difference between fintech apps and traditional services is their incorporation of advanced features like AI, data analytics, etc. These features allow users to enjoy a more comprehensive and user-friendly financial experience.

The primary reason for fintech solution development is to get your finances at your fingertips. From budgeting tools to investment options, fintech apps provide control and resources to help you make financial decisions and reach your goals.

The Top Fintech Trends You Need to Know

The Fintech Industry is experiencing tremendous growth, and many new emerging trends will define the Fintech market in the coming years.

- Embedded Finance: In fintech mobile app development, embedded finance seamlessly integrates financial services with non-financial apps.

- Open Banking and APIs: This open banking trend promotes the safe sharing of monetary data between authorized third-party apps and traditional banks.

- AI and ML: Fintech app development is on the path of AI transforming financial services with automated financial management tools and personalized investment advice.

- Buy Now, Pay Later (BNPL) 2:0: As today BNPL is popular, it is increasing its spending limits with wider merchant adoption and even a BNPL option for larger purchases.

- Biometric Authentication: Fintech app development services are increasingly adding fingerprint, voice recognition, and facial recognition for secure user authentication.

A Must Read: Top 9 FinTech trends to look out for in 2024-2025

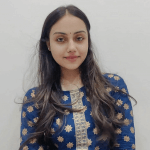

Types of Fintech Apps

To develop an innovative fintech app, work on new ideas while keeping a specific target audience in mind. Let us look at some of the most prominent types of fintech apps.

1. Mobile Payments Apps

Fintech app development is driven by the mobile payment apps in the financial sector. These apps allow users to ditch their wallets, cards and make seamless smartphone payments. Mobile payment apps are speedy, convenient, and secure alternatives to traditional payment methods.

The apps keep track record of your money, so budgeting gets easier. An additional bonus point of these apps is that they offer rewards and cashback for some extra spending. There are many advantages of mobile app payments, such as

- Security

- Speed and Convenience

- Budgeting and Tracking

- Cashback and Rewards

Examples: Apple Pay, Google Pay, Venmo

2. Insurance Apps

Insurance companies and independent brokers are now offering modern insurance apps that are transforming the fintech industry. These apps provide convenient and centralized platforms to manage all your insurance requirements.

The apps also help in getting significant insights into insurance policies and benefits. There are some key advantages of these insurance apps:

- Convenience and Accessibility

- Transparency and Information

- Personalized Risk Management

- Transpeanrcy and Information

Examples: Lemonade, Progressive, Clover Health

3. Banking Apps

Banking apps are considered as revolutionary fintech application development. It has changed the access and management of our financial needs and become a core part of the fintech industry. All the traditional banks and neo-banks offer their personal banking apps.

Apps provide a convenient and secure alternative to traditional brick-and-mortar banking. The accounts are easily accessible, have robust security, and good financial management. Here are some major advantages of these banking apps:

- 24/7 access

- Remote Banking Features

- Improved Financial Management

- Enhanced Security

Examples: Chase Mobile, Chime, Ally Mobile

4. Budgeting Apps

In the realm of the fintech industry, budgeting apps have emerged as the champion for financial management, control, and awareness. The apps empower users to make correct decisions with their money. The apps give a platform to analyze, manage, and track the budget.

The BFSI Software have features like goal setting, bill reminders, etc, to cultivate good financial behavior. Here is a closer look at the key advantages of budgeting apps:

- Financial Clarity

- Track Expenses

- Forecast and Analyze

- Debt Management

- Better Savings

Examples: Mint, YNAB, PocketGuard

5. Loan Apps

Loan apps in the fintech industry have truly transformed the way people access their money and credits. These particular fintech apps are built to get faster and more convenient loans compared to traditional banks. It is more suitable for smaller loan amounts, as it is really easy to get in a faster timeline.

Loan apps give flexible loan options, with clear disclosure of loan terms, fees upfront, and interest rates. Here are some of the key advantages of these loan apps.

- Speed and Convenience

- Accessibility

- Flexible Loan options

- Transparency

Examples: Upstart, SoFi, Earnin

6. Investment Apps

Investment apps have changed the way people participate in financial markets. The apps have user-friendly platforms within the fintech industry to empower every individual investor with ease and convenience.

These apps have broken down the barriers that once existed for many with their rich resources and low fees. There are many key benefits of investment apps; here are some examples:

- Accessibility

- Fractional Shares

- Low Fees

- Automated Investing

Examples: Stash, Acorns, Robinhood

“A shining example of OpenXcell’s innovative FinTech solutions is the Power Traveler app. Designed specifically for credit card holders, this app unlocks a world of benefits, granting access to over 500 exclusive offers.”

Must-Have Fintech App Features

- Multi-Factor Authentication: In any fintech application development, it is essential to give users’ accounts an extra layer of security beyond passwords with multi-factor authentication.

- Data Encryption: All user-sensitive financial data must be protected with proper data encryption features.

- Secure Login Protocols: For login in any Fintech app, there should be strong protection and data safeguarding during communication.

- Account Management: All FinTech applications must give users proper account information with a precise balance track and account settings.

- Seamless Transactions: There should be various transaction ways enabled in apps relevant to payments, investments, transfers, tracking, etc.

- Intuitive Interface: Work on fintech application development which have a user-friendly and easy-to-navigate design.

- Real-time updates: Keep users updated about their accounts with all relevant account notifications and push notifications as well for real-time updates.

- Customer Support: There should be reliable customer support in fintech apps 24/7 to solve user queries quickly.

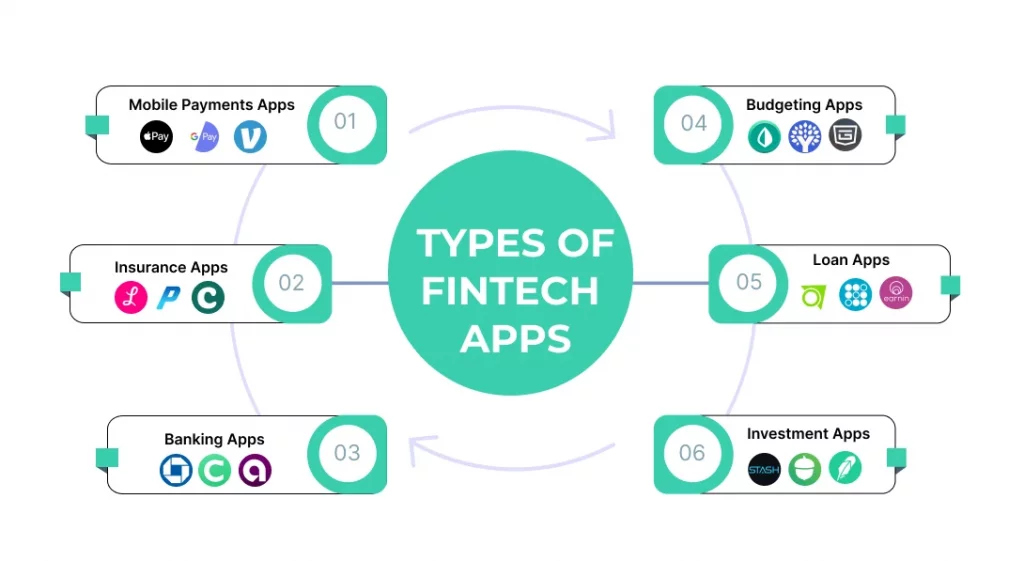

How to Build a Fintech App in 7 Steps

For the booming popularity of fintech apps, this guide provides a detailed breakdown of the development stages for creating your successful fintech mobile application.

1. Identifying Idea and Concept

- For any financial app development, first and foremost, you must identify your niche, as fintech is a vast market. It is essential to find specific problems and gaps in the market and address them with your app.

- Also, it is better to research and learn from the existing competition. Analyze other strengths and weaknesses to identify opportunities for your app to stand out.

- After the complete concept analyses, define the core benefits and uses of the app for the users.

2. Market Research and User Validation

- Before starting the fintech app development, make sure your concepts resonate with the audience.

- Dive deep into the proper market research of your target audience and understand the financial needs, pain points, and habits of customers.

- The other research methods are user validation, conducting a survey, focusing on groups, getting feedback on the concept, and ensuring your app is market fit.

3. Define App Features and Functionalities

- After properly conceptualizing the app, it’s time to translate the concepts into a tangible app with prioritized features.

- As per the market research, define the core functionalities of the apps that will work as the selling point.

- Design the app with a user-friendly and intuitive interface that makes interaction and navigation effortless.

4. Choosing Your Technology Stack

- For fintech application development, it is crucial to have a proper technical foundation and the right tools.

- Select programming languages, development tools, and frameworks that best suit your app’s functionality and requirements.

- Since security is paramount in fintech apps, the development process must integrate robust practices to safeguard user data.

5. Development and Testing

- When the app is designed and the tech stack is in place, that is when the next step of development comes to work.

- Use the chosen technology stack to develop the app, focusing on security, functionality, and seamless user experience.

- After implementation, test the app through rigorous testing, pinpoint the bugs and glitches, and fix them rightfully.

6. Deployment and Launch

- When the testing is completed and the app is user-friendly enough, launch the app and give it to the hands of users.

- Prepare your app’s submission to the relevant app store ( Play Store or App Store) or launch the web app following the correct guidelines.

- Deploy the app by generating awareness through marketing strategy with relevant partners.

7. Maintenance and Updates

- Even when your fintech app development is completed, and the app is launched, continuous work is to be done.

- Keep your app secure and stable with new updates, features, security patches, and bug fixing. This increases user engagement and addresses the evolving needs.

- Gather continuous user feedback after launch and use their valuable input to improve the app constantly.

Tech Stack for Fintech App Development

The tech stack holds tremendous importance in fintech mobile app development; you need to have the proper tools and technology for app development.

| Layer | Technology | Description |

| Front-End | React, Angular, Vue.js | Popular JavasScript libraries/frameworks are used to build user-friendly interactive interfaces. |

| Back-End | Java, Node.js, Python (Django/Flask), Ruby on Rails | These programming languages build robust and scalable server-side logic. |

| Database | PostgreSQL, MySQL, MongoDB | Databases store and manage financial data securely. PostgreSQL gives ACID compliance and security. MySQL gives ease of use, and MongoDB is a NoSQL option in scalability. |

| Cloud | AWS, Microsoft Azure, Google Cloud Platform | Cloud offers on-demand infrastructure and services for reliability and scalability. |

| Security | OAuth 2.0, Transport Layer Security (TLS) | The security layers are for protocols of secure user authentication and data encryption. |

| API & Integrations | Open Banking APIs, Third-party payment processors | API & Integrations connect the apps to payment gateways for account linking and transactions. |

| Other | Blockchain, AI/ML, Big Data Analytics | The new emerging technologies enhance security, fraud detection, personalization, and data-driven insights. |

The table is the general recommendation or most used tech stack in fintech apps. The correct tech stack depends on the project’s requirements, budget, scalability goal, etc.

A Good Read: Blockchain in Fintech: The Fintech Boost Everyone Was Counting on!

A Complete Breakdown of Fintech App Development Cost

The cost of fintech app development depends on various factors and aspects that make an estimated cost structure. It mostly depends on the app’s complexity, platform, tech stack, and other features

Let’s break down the cost of fintech app development by every development stage.

1. Idea and Planning

- The app’s concept, core functionalities, analyses, and market research decide the project’s roadmap.

- The average cost of the planning and creativity costs around $5,000 -$20,000.

2. Design and Prototyping

- User Interface and User Experience are important for building user-friendly and intuitive apps.

- Developing interactive prototypes for user testing and feedback costs around $10,000 – $30,000.

3. Development

The development of fintech apps is highly variable, as it depends on the complexity of features.

- Front-End Development: The development is based on the iOS, Android, or cross-platform platforms.

The average front-end cost is around $20,000 – $100,000+.

- Back-End Development: The back-end development depends on integrations and data complexity.

The average cost of the back-end is approximately $30,000 – $150,000+.

- API Integration: The fintech app integrations involve payment gateways, bank transactions, etc.

The cost of API integrations is around $5,000 – $20,000+.

4. Testing & Quality Assurance

- The rigorous testing ensures app functionality, performance, and security on different devices.

- The test and quality of this step cost around 10 – 20% of the development cost.

5. Deployment & Maintenance

- The app store submission fee, ongoing server maintenance, and infrastructure costs are variable.

- Costs are variable based on the app’s complexity, bug fixes, and feature updates.

| Step | Hours | Average Cost |

| Idea & Panning | 30-60 | $5,000 -$20,000 |

| Design & Prototyping | 80-110 | $10,000 – $30,000 |

| Development – Front- End Back-End API Integration | 160- 400 240- 800 40- 100 | $20,000 – $100,000+ $30,000 – $150,000+ $5,000 – $20,000+ |

| Testing & Quality Assurance | 40-80 | Variable |

| Deployment & Maintenance | Ongoing | Highly Variable |

Various Fintech App Monetization Strategies

The substantial revenue generation potential of fintech apps is attracting many financial organizations to partner with fintech app development company’s.

1. Transaction Fees

The transaction fees include small fees for specific financial transactions made on the apps.

- It also includes domestic and international money transfers.

- Bill Payments

- Peer-to-Peer Payments

- Currency Exchange

2. Subscription Model

The subscription model fee includes premium functionalities or features.

- It includes Advanced budgeting and financial management tools

- Priority customer support

- High transaction limits

- Investment research and analysis report

3. In-app Advertising

There are integrated, non-intrusive, relevant advertisements in the app generating money.

- The cost per mile has a fixed amount for every 1,000 impressions of the ad.

- The cost per click earns money whenever a user clicks on the ads.

4. Freemium Model

- The apps have free versions with limited features and incentive users.

- Where freemium models have access to advanced features and unique user benefits.

5. Marketplace Model

- The app facilitates transactions between users and businesses within the app and charges a commission on every transaction.

- Loan marketplaces connect borrowers with lenders and benefit money from it.

- It can be relevant features like wealth management platforms connecting customers to financial advisors.

Additional Read: Digital Transformation in Banking: Beyond Online Banking

Empower Your Fintech App Development Vision with OpenXcell

Harness the power of fintech app development with Openxcell. We are known for building secure, user-friendly fintech apps that will revolutionize money management.

We guide you through every fintech application development process: From concept to prototyping, seamless development, and rigorous testing and deployment. Partner with Openxcell and unlock the full potential of Fintech.